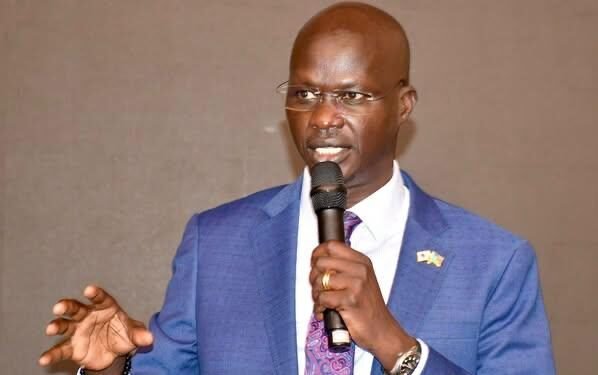

The Bank of South Sudan (BoSS) governor Dr. Addis Ababa Othow has announced a series of key priorities aimed at stabilizing the foreign exchange market, strengthening the economy and promoting digital financial inclusion.

In a stakeholders’ meeting held in Juba over the weekend, Dr. Othow also issued a firm warning against unethical banking practices and called for strict compliance with national policies.

Dr. Othow reaffirmed the bank’s commitment to expanding access to affordable digital payment systems, urging commercial banks and mobile money providers to intensify public awareness campaigns.

He highlighted the benefits of digital transactions, such as reduced cash-handling risks, enhanced security, and greater convenience, as South Sudan moves toward digital transformation.

“Electronic payments are now recognized as official legal tender. Banks that resist this change and cling to cash-based operations are going against national policy. The world is moving digital; South Sudan must not be left behind,” Dr. Othow stressed.

On the foreign exchange front, the Governor expressed strong concern over unauthorized currency trading, including parallel market auctions and unapproved book-value FX rates conducted outside of BoSS regulations.

He described these practices as “economic sabotage” and warned that any banks or institutions found to be involved would face severe penalties, including license revocation.

To ease cash shortages for civil servants and the public, Dr. Othow confirmed that BoSS has started disbursing South Sudanese Pounds (SSP) to commercial banks nationwide.

He also assured stakeholders that foreign exchange auctions would continue as part of ongoing efforts to stabilize the market.

For his part First Deputy Governor Samuel Yanga echoed the Governor’s warnings against non-compliance with BoSSmandates and confirmed that both SSP funds and hard currency auctions have been initiated to help facilitate salary payments and stabilize the market.

The meeting was attended by senior BoSS officials, managing directors of commercial banks, telecom executives, and other key stakeholders, signaling a unified approach to addressing the nation’s economic challenges.