The annual inflation rate in South Sudan surged to 661.3 percent in July of 2016, from 309.6 percent in the previous month, as the country faces food shortages amid civil conflicts. Cost rose sharply for: food and non-alcoholic beverages (788.6 percent from 373.9 percent in June), followed by health (163.4 percent from 39.7 percent), restaurant and hotels (277.5 percent from 114.9 percent), furnishing and housing equipment (303.5 percent from 214.5 percent), alcoholic beverages and tobacco (403.7 percent from 76.8 percent), transport (658.3 percent from 644.8 percent) and housing and utilities (549 percent from 218.6 percent). Month-on-month, consumer prices jumped 77.7 percent.

With each glance and every little movement you show it. Love is all around, no need to waste it

The Central Bank of South Sudan cut its benchmark interest rate by 200 bps to 13 percent during an unscheduled meeting on April 28th 2020, to help to cushion the economy from the negative effects of the novel coronavirus. The Committee also reduced the reserve requirement ratio by the same margin to 18% from 20%, in order to boost liquidity and support lenders.

The Bank of South Sudan is the central bank of the Republic of South Sudan. Established in July 2011, by an Act of Parliament (The Bank of South Sudan Act, 2011), it replaced the now defunct Bank of Southern Sudan, a branch of the Bank of Sudan, which had served as the central bank of Southern Sudan, during the period between February 2005 until July 2011. The bank is fully owned by the Government of South Sudan.

Here’s the story of a lovely lady, who was bringing up three very lovely girls. All of them had hair of gold, like their mother, the youngest one in curls. Here’s the store, of a man named Brady, who was busy with three boys of his own. They were four men, living all together, yet they were all alone.

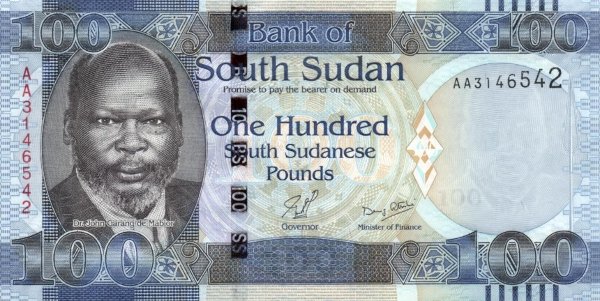

South Sudan, Africa’s youngest nation, uses the South Sudanese Pound (SSP) as its official currency, divided into 100 piasters. Here’s an overview of the banknotes:

- Current Denominations and Features:

- The banknotes currently in circulation include denominations of 1, 5, 10, 20, 50, 100, 500, and 1,000 South Sudanese Pounds.

- The notes feature the portrait of John Garang de Mabior, a key figure in South Sudan’s independence movement, on the front.

- The reverse sides of these notes display various native species and natural landmarks, reflecting the country’s rich biodiversity and heritage.

- Recent Developments:

- In 2024, the Central Bank of South Sudan introduced a new 1,000 SSP note. This new series is named “South Sudan Pound” instead of “South Sudanese Pound,” aligning with regional practices of naming currencies after the country. This change was part of a legislative update in 2023, where the currency name was officially amended.

- Inflation and Currency Management:

- South Sudan has faced challenges with high inflation, leading to the introduction of higher denomination notes (like the 500 SSP in 2018 and 1,000 SSP in 2021) to facilitate easier transactions as the purchasing power of lower denominations diminishes.

- The Central Bank has periodically reviewed and adjusted the denominations to manage the currency’s circulation amidst economic conditions, including inflation and the need for efficiency in currency handling.

- Security Features:

- The banknotes are equipped with various security features to combat counterfeiting, including watermarks, security threads, and microprinting.

- Public Awareness and Transition:

- With each new note issuance or change, the Central Bank undertakes public awareness campaigns to educate citizens about the new currency features, ensuring a smooth transition and acceptance.

- Economic Context:

- South Sudan’s economy heavily relies on oil, which influences its currency’s value on the international market. The currency’s stability is also affected by internal political stability, international relations, and economic policies.

This information reflects the ongoing efforts by the Central Bank of South Sudan to manage the national currency in a way that supports economic transactions and reflects national identity amidst economic challenges.